- Home

- Reports

- Real Estate Trends

- Trends in the Real-Estate Market No. 17

- Home

- Reports

- Real Estate Trends

- Trends in the Real-Estate Market No. 17

Be the first to know about industry trends and indicators.

Trends in the real-estate market during the first quarter of 2023

Num. 17 - March 2023

Highlights of the quarter: January - March 2023

The new edition of G-Trends is now available, Gloval’s report that gathers the keys of the quarter regarding the macro environment, the analysis of the real estate segments and delves into certain current issues. You can download the full report at the following link:

As 2023 progresses, more accurate figures are becoming available for estimating growth forecasts for the Spanish economy. With the first quarter over, the main institutions and agencies for economic analysis point to GDP growth of around 1.5% for this year, perhaps due to the fall in energy prices and the recovery in tourism.

Interest rates and the CPI remain a constraint on further expansion of private consumption and Gross Fixed Capital Formation (investment). The ECB is expected to continue its tight monetary policy until inflation is brought under control or employment is threatened.

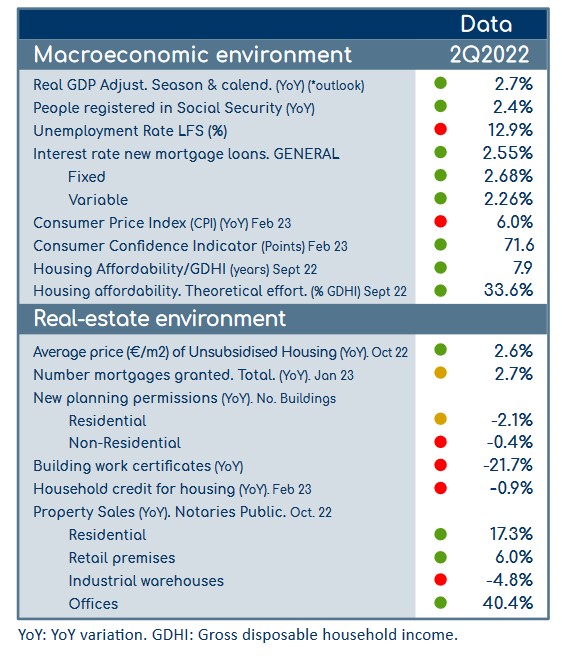

The real estate sector, like practically all production sectors, is showing signs of a change in trend. The residential sector is seeing some reductions in new building permits and in work completion certificates, although the average house price valuation is up by almost 3%. As a result of the rise in interest rates, lending to households also fell somewhat, and in commercial real estate, compared to the same period last year, the number of transactions in the first quarter of 2023 rose for residential, retail and offices for services, but fell for industrial warehouses.

Balanced Scorecard - IVQ22

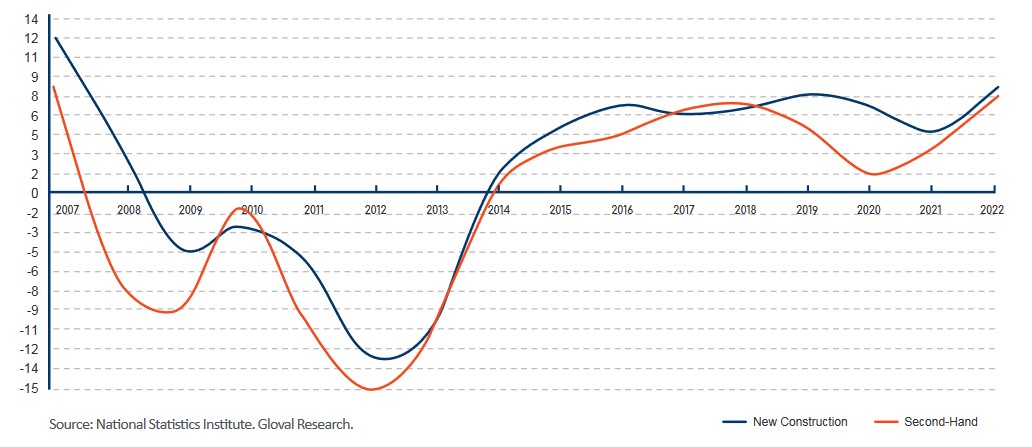

Evolution of the House Price Index (HPI). New and Existing Homes

The House Price Index measures the evolution of the sale prices of unsubsidised housing in its New Construction and Second-Hand formats. As it is a harmonised indicator, it can be used as a tool to make comparisons with other European (EU) countries. The information obtained is based on deeds recorded by the Professional Association of Notaries Public. Purchases made by legal entities are excluded. Its main objective is to measure the evolution of the sale price of unsubsidised housing purchased by households in Spain, adjusting for

changes in the composition and quality of the housing purchased in different periods using a method that combines stratification with a regression model, as explained by the INE.

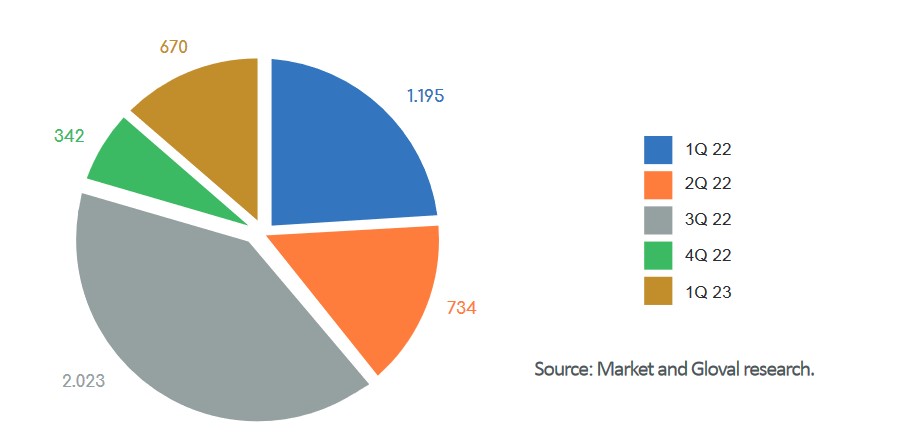

The rise of so-called alternative real-estate assets

In the first quarter of 2023, so-called alternative assets have accounted for an estimated investment of around €670 million, where practically 100% of transactions have been on the buyer’s side, that is, the investor appetite is notable in this type of assets; purchases and purchase of land or assets for remodelling or repositioning. There has been one sale, by Home Capital, of Calle Santa Engracia for corporate rental for around €5 million, and the new buyer could put it to another use. Of all the different types of assets, retirement homes accounted for 30% of the total investment, the rest being divided between student halls of residence, BtR and educational.

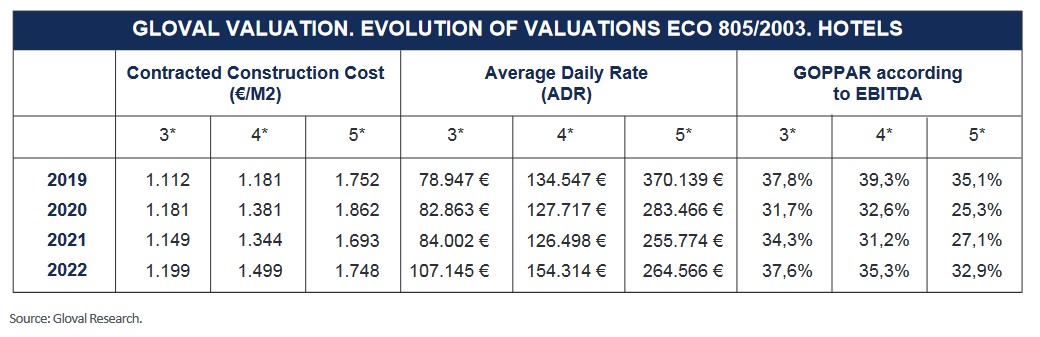

HOTELS. Gloval mortgage guarantee valuations

The hotel segment in Spain is one of the real-estate assets where the appetite of both national and foreign investors is once again focused, especially that of the large chains, which have completed several transactions in the early months of 2023.

Hotels, like any real-estate asset are mostly bought using some of the purchaser’s own money and some external financing (debt), most of which is through the classic procedure of bank financing, although so-called alternative financing is becoming increasingly accepted.

Gloval Valuation is one of the three leading appraisers in the domestic market and is leader in the hotel segment in conducting valuations for the purchase of hotel assets.

You may also see our previous GTrends Reports and our latest GIX Report, where we analyse the main real-estate economic indicators in Spain.

Fill in this form by clicking on the download button and we’ll send you the GTrends Report No. 17:

View other reports

Nothing found.

Download several reports

You can download all our reports at the following link:

Let’s have a chat

Let us know what you need and we’ll contact you as soon as possible.