- Home

- Reports

- Real Estate Trends

- Trends in the Real-Estate Market No. 12

- Home

- Reports

- Real Estate Trends

- Trends in the Real-Estate Market No. 12

Be the first to know about industry trends and indicators.

Trends in the real-estate market during the last quarter of 2021

Num. 12 - January 2022

Highlights of the quarter: October to December 2021

Gloval publishes its latest issue of the Gtrends Report for the last quarter of 2021. Here are the highlights. You can download the full report from this link:

2021 ends on a hopeful and optimistic note for the Spanish economy and the real-estate sector in spite of the reappearance of new Covid variants and outbreaks, as it hasn’t yet been eradicated. Among the main lines marking the economic landscape and the different segments in the real-estate market, it is worth mentioning:

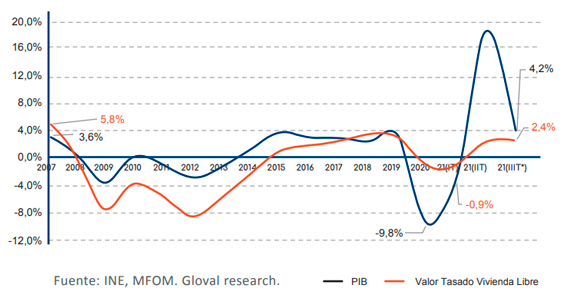

Macroeconomic environment

Previsiones de crecimiento del PIB del 7%, nuestras estimaciones apuntaban a rangos próximos al 5,5%. La demanda se resiente en confianza de los consumidores y en una subida continuada de los precios (IPC) y de los costes de materiales. La oferta, consecuencia de la situación sanitaria, se ve afectada en prácticamente todos los sectores productivos.

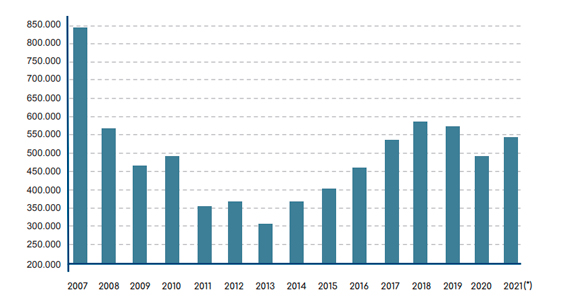

Residential segment

Esta área mantendrá la tendencia de crecimiento iniciada en 2021 con un aumento de promociones de obra nueva y salida al mercado de las promociones en curso iniciadas en 2021. El mercado del alquilar será un gran protagonista en cualquiera de sus afecciones, y tomará protagonismo la sostenibilidad en las viviendas.

Logistics/Industrial segment

Segmento que no parece conocer el techo. A pesar de toda la cartera en construcción en las principales plazas como Madrid y Barcelona, la demanda sigue siendo muy superior a la oferta actual, dada la escasez de producto con características propias para el E-commerce o distribución de última milla. El interés por suelos en Polígonos con producto anticuado y suelos en desarrollo será el objetivo para este 2022.

Office segment

Greater interest in well-located prime areas such as 22@, as shown by the yield compression, with 3.25% in Madrid and 3.5% in Barcelona overall.

Retail segment

It remains appealing because of supermarkets, as proved by recent major transactions. Caution is still shown towards street-level premises and shopping centres, with greater interest in High Street premises and retail parks.

Hotel segment

Vuelve a entrar en zona de notable incertidumbre con la propagación de la variante Ómicron del virus, lastrando las cuentas de resultados de los hoteleros, tanto a nivel vacacional o playa como urbanos. El notable nivel de los profesionales que gestionan el parque de activos hoteleros en nuestro país les dota de una resiliencia ejemplar.

Gloval’s Vision

For this month’s GLOVAL’s Vision, we tackle an important topic which is the new Covered Bonds market under Spanish Royal Decree Law 24/2021. This Royal Decree, specifically Title II, Chapter 4, Articles 16 to 18, sets forth the valuation of assets under coverage, where Surveyors authorised by the Bank of Spain (i.e. GLOVAL), will be the firms assigned to conduct annual valuations.

Download the GTrends Report Num. 12 here:

View other reports

Nothing found.

Download several reports

You can download all our reports at the following link:

Let’s have a chat

Let us know what you need and we’ll contact you as soon as possible.